Gate fees, or tipping fees, are what you pay to dump waste at landfill sites. These fees change a lot based on where you are, the waste type, and the landfill you use.

It's key to understand landfill gate fees for good budget planning. For example, Perth, Ontario charges £128.20 per tonne for regular waste. But, construction and demolition waste costs £160.30 per tonne. That's fairly typical for the developed nations, with generally lower rates in developing countries.

If you run a small business, manage a council, or just want to know about waste management prices, knowing these disposal costs is important. It helps you make smart choices about handling your waste.

Key Takeaways

- Gate fees are charges paid to dispose of waste at landfill facilities

- Costs vary significantly by location, waste type, and facility

- Regular solid waste typically costs less than construction debris

- Understanding fee structures helps optimise waste management budgets

- Regional variations can impact your overall disposal strategy

- Proper planning reduces unexpected tipping fee expenses

Understanding Waste Disposal Costs in the UK

In the United Kingdom, waste disposal costs vary based on several factors. These include the type of waste, where you are, and how you dispose of it. Most places charge by weight, making heavier waste more expensive.

The main cost factor is gate fees. These cover the costs of managing waste, including transport and recycling. Knowing these fees helps you plan your budget better and find cheaper ways to dispose of waste.

When you dispose of waste, several costs add up. Rubbish tipping charges include the basic fee, environmental taxes, and maintenance. Extra fees might apply for special or hazardous waste.

Weight is the key factor in calculating costs. Facilities use weighbridges to measure waste accurately. This fair pricing encourages reducing waste across different sectors.

| Cost Component (Global) | Typical Range | Billing Method | Primary Factors |

|---|---|---|---|

| Gate Fees | £80-£150 per tonne | Weight-based | Waste type, location |

| Landfill Tax | £98.60 per tonne | Government rate | Standard rate materials |

| Transport Costs | £15-£45 per load | Distance-based | Location, fuel prices |

| Administrative Fees | £5-£25 per visit | Fixed charge | Documentation, permits |

Where you are affects waste disposal costs. Cities often have higher charges due to higher costs and less space. Rural areas might have lower rates but more transport costs.

The type of waste also changes prices. General household waste usually has standard rates. But construction waste, garden waste, and hazardous materials have different prices. Some waste can even get cheaper rates or recycling credits.

Seasonal changes also impact prices. Spring cleaning or construction peaks can raise costs. Disposing waste during off-peak times can save money.

Understanding these costs helps you manage waste better. Whether it's household or commercial waste, knowing how costs are set lets you budget well. It also helps you look for cheaper disposal options.

Landfill Gate Fees Explained

Gate fees, or waste site tariffs, are the costs you pay to dispose of waste at landfills in the UK. These fees cover the costs of running the landfill and meeting environmental rules.

Gate fees are essential for keeping landfills running and managing waste properly. Knowing how they work helps you plan your waste disposal better.

Definition and Basic Structure

Gate fees are mandatory payments for each tonne of waste at landfills. These fees are key to waste disposal costs in the UK.

The fee structure is simple. You pay a set rate per tonne of waste, with rates changing based on waste type and location. Most use weight-based calculations for fair pricing.

Both private operators and local authorities charge gate fees. Private sites might offer more flexible pricing, while council sites have fixed rates.

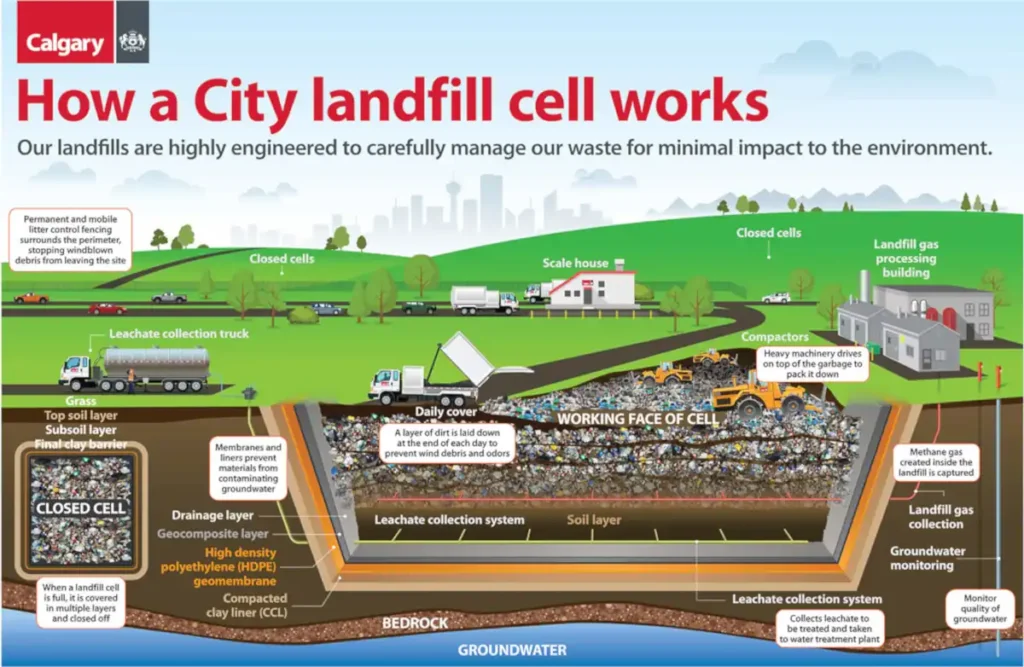

“How a landfill works” from www.calgary.ca and used with no modifications.

Components of Gate Fees

Gate fees include several main parts. Operational costs are the biggest, covering staff, equipment, and site management.

Environmental compliance costs are also high. These cover monitoring, pollution control, and legal reports needed to operate legally.

Landfill tax is another big part. Facilities pay a tax on each tonne of waste, which they pass on to customers.

Finally, private operators make a profit. This profit varies based on competition and capacity, affecting your final cost.

How Charges Are Calculated

Charges are usually simple: total cost equals waste tonnage times the rate per tonne. Weighbridges at entrances ensure accurate billing.

Some sites have minimum charges for small loads. This helps them cover costs for all deliveries.

Volume-based pricing applies to lighter materials like packaging. This considers space used, not just weight, for fair pricing.

Negotiated rates are available for regular customers. Long-term contracts often get better prices than one-off payments, especially for businesses.

UK Landfill Tax Rates for 2025

Knowing the landfill tax framework is key for businesses and councils. The UK landfill tax 2025 structure affects your waste disposal costs. This tax is a big part of what you pay at licensed facilities.

The government uses these charges to encourage less waste and more recycling. Every tonne of waste you dispose of has this tax. It's vital to know the different rates.

Standard Rate Charges

Most waste types fall under the standard rate for landfill tax rates. This includes household and commercial waste, and general industrial materials. These don't get lower charges.

The standard rate applies to:

- Mixed household and commercial waste

- Food waste and organic materials

- Textiles and packaging materials

- Non-hazardous industrial waste

This rate is the biggest part of your disposal costs. Planning ahead with waste segregation can lower your costs.

Lower Rate Categories

Certain materials get lower tax rates, saving you money. These lower rate categories include inert materials that are less harmful to the environment.

Materials eligible for lower rates include:

- Rocks, stones, and mineral waste

- Concrete and brick rubble

- Ceramic and glass materials

- Soil and subsoil (uncontaminated)

Separating these materials from general waste can save you a lot. Many construction and demolition projects benefit from proper waste segregation.

Recent Legislative Changes

The government has made several updates to the landfill tax system. These recent legislative changes aim to discourage landfill use and promote sustainable waste management.

Key changes include better enforcement and stricter classification rules. The tax escalator increases rates each year, making other waste treatment methods more appealing.

New reporting rules also affect how waste operators classify and charge materials. Staying informed about these changes helps you make better waste management decisions.

The impact on your business depends on your waste composition and volumes. Regularly reviewing your waste streams can help you find ways to save money.

Commercial Waste Disposal Pricing

Understanding commercial waste fees is key for businesses to manage their waste well. In the UK, costs vary by industry and how much waste is produced. The pricing reflects the complexity of handling different types of waste from various businesses.

Today's businesses face many pricing options to find the best deals. Tipping fees waste management companies charge based on the type of waste, how much, and how often it's collected. These factors affect your monthly waste budget and planning.

Types of Business Waste

Businesses produce different types of waste, each with its own cost. General waste includes office paper, packaging, and non-hazardous trash from daily activities. Food waste needs special handling and costs more due to strict rules.

Hazardous materials have the highest fees because they need special disposal methods. Construction sites produce a mix of waste like timber, metal, and concrete. Each type has its own pricing set by waste management providers.

Recyclable materials can lower costs through rebates. Many businesses separate items like cardboard, plastics, and metals to get lower rates.

Flexible Volume Pricing

Volume-based pricing is good for businesses with changing waste needs. Seasonal retailers and event companies save money by only paying for what they generate. This is better than fixed monthly fees.

Manufacturing sites with changing production levels also benefit from volume pricing. Waste management providers often offer lower costs for more waste. Small businesses like the flexibility to adjust services as needed.

Service Agreement Options

Long-term contracts can offer better rates and reliable service for steady waste. These agreements last from 12 to 36 months with set prices. Businesses with stable waste needs find this predictable.

Pay-as-you-go options are flexible but cost more. They're best for businesses with changing or temporary waste needs. Start-up companies often choose flexible plans until their waste patterns settle.

| Service Type | Pricing Structure | Best Suited For | Average Cost Range |

|---|---|---|---|

| Annual Contract | Fixed monthly fee | Established businesses | £150-£800/month |

| Volume-Based | Per tonne charges | Variable production | £120-£300/tonne |

| Pay-as-You-Go | Per collection fee | Irregular generators | £80-£200/collection |

| Hazardous Waste | Specialist pricing | Industrial operations | £400-£1,200/tonne |

Choosing the right pricing model needs careful thought about your waste and business needs. Consider how often waste is collected, container sizes, and extra services when looking at costs.

Council and Municipal Landfill Rates

Knowing your local council's waste disposal fees is key to smart rubbish management. Council landfill rates differ a lot across Britain. Some places charge a bit, while others don't charge at all for residents. These rates show how each area manages waste, uses facilities, and cares for the environment.

Local councils try to balance costs with encouraging the right disposal habits. The price difference can really change how people act. For example, in Sudbury, £5 fees have made some try to donate items to charity shops instead of paying to dispose of them.

Authority Pricing Structures

Local authority charges usually follow a few models. They aim to cover costs while promoting green practices. Most councils offer free disposal for regular household waste but charge for certain items.

Construction materials, large appliances, and garden waste often have their own fees. These help councils manage the cost of special items. Businesses usually pay more than residents.

Some councils charge a small fee to discourage unnecessary visits. But, they must be careful not to encourage fly-tipping. This could lead to more environmental and financial problems.

Recycling Centre Charges

Household waste recycling centres are the main place for most people to dispose of waste. The fees vary a lot between places. Council landfill rates at these centres depend on the type and amount of waste, and if you're a resident.

Many centres let you dispose of regular household items for free. But, they charge for things like construction debris, tyres, or a lot of garden waste. Some offer special permits or vouchers for big clear-outs or home improvements.

The fees can really affect how people dispose of waste. Small fees might encourage people to make fewer trips. But, higher fees might make some choose private waste services instead.

| Council Area | Standard Household Waste | Construction Materials | Garden Waste | Large Appliances |

|---|---|---|---|---|

| Surrey County | Free | £3.20 per bag | £3.20 per bag | £15.00 each |

| Birmingham | Free | £2.50 per bag | Free | Free |

| Cornwall | Free | £4.00 per bag | £2.00 per bag | £10.00 each |

| Manchester | Free | £5.00 per bag | £1.50 per bag | £12.50 each |

Understanding your local council's fees helps you manage waste better. Many councils also offer special services for big items. This can be cheaper than going to the centre many times.

Factors Affecting Rubbish Tipping Charges

Rubbish tipping charges change due to many factors in the UK waste management sector. These factors create different prices across the country. Knowing these helps you choose the best time and place for waste disposal.

Prices are influenced by local markets, rules, and costs of running facilities. Each site tries to stay competitive while balancing these factors.

Waste Type and Classification

Waste types have different disposal costs based on their environmental impact and processing needs. Hazardous waste needs special handling, which costs more.

Construction waste is cheaper because it's not harmful to the environment. It also needs simpler processing.

Organic waste has a middle price. It needs careful handling to avoid methane emissions. The environmental levy often applies here.

Mixed general waste costs more because it's harder to sort and process. This includes household and non-segregated commercial waste.

Geographic Location Impact

Prices vary by region in the UK. Places with less landfill space charge more due to scarcity and transport costs.

Urban areas face higher costs because of property values and strict rules. They have to spend more on pollution controls.

Rural sites might charge less but add transport costs. The environmental levy also varies by region, based on local policies.

| Location Type | Base Rate Range | Additional Factors | Typical Surcharges |

|---|---|---|---|

| Urban Centres | £85-120 per tonne | High property costs, strict regulations | Congestion charges, extended hours fees |

| Suburban Areas | £70-95 per tonne | Moderate capacity, standard compliance | Weekend premiums, volume discounts available |

| Rural Locations | £60-85 per tonne | Lower overheads, transport considerations | Distance charges, minimum load requirements |

| Coastal Regions | £75-100 per tonne | Environmental sensitivity, tourism impact | Seasonal restrictions, marine protection fees |

Seasonal and Market Variations

More waste is generated during warmer months due to construction. This increases demand and prices from March to September.

Economic ups and downs affect waste and disposal costs. Growth means more waste, while recessions focus on cheaper materials.

Fuel price changes affect transport costs, which facilities pass on to customers. Diesel price hikes hit rural areas hard.

Market changes in waste management impact prices. Fewer facilities mean higher rates in some areas.

Changes in rules can raise costs suddenly. Facilities must invest in new systems. The environmental levy also changes annually, affecting prices.

Environmental Levy and Additional Charges

Today, waste disposal costs have a big environmental part. This supports rules to protect our planet and funds for cleaning up. Knowing these extra costs helps you choose the best way to manage waste.

Environmental levies do more than follow rules. They help pay for projects to reduce carbon emissions and clean up sites. The cost varies based on the type of waste and where it's sent.

Landfill Tax Components

Landfill tax is a big part of environmental charges in the UK. It's set to reduce landfill use and fund green projects. Materials like household waste pay more than things like concrete.

The tax has two types: active and inactive waste. Active waste, like household trash, pays the standard rate. Inert materials, like concrete, pay less. This encourages recycling and sorting waste.

There are also costs for site restoration and monitoring. Companies must show they can clean up after they close. This protects taxpayers from dirty sites left behind.

| Charge Type | Standard Rate (£/tonne) | Lower Rate (£/tonne) | Purpose |

|---|---|---|---|

| Landfill Tax | 102.10 | 3.25 | Discourage landfill use |

| Environmental Monitoring | 5.50 | 2.75 | Site compliance checks |

| Restoration Bond | 8.25 | 4.15 | Future site remediation |

| Carbon Offset Levy | 3.75 | 1.85 | Climate change mitigation |

Gate Fees for Waste-to-Energy Facilities

Gate fees for waste-to-energy plants are different from landfill charges. These plants make money by producing electricity. But, they also have extra costs for processing and controlling emissions.

Waste-to-energy plants need special systems to reduce pollution. They must also check emissions regularly. These costs are added to the gate fees.

These plants can get money back through green energy certificates and government help. This makes their costs competitive with traditional waste disposal. Charges can be between £85-120 per tonne, depending on the waste.

Some places include environmental costs in the basic fee, while others list them separately. This makes it harder to compare prices. Always ask for a detailed breakdown when looking at waste disposal options.

Regional Differences in Waste Site Tariffs

Waste site tariffs vary across Britain. This is due to local infrastructure, rules, and market changes. These differences can greatly affect your waste disposal costs, especially for businesses with sites in different areas. The wrap gate fees report often points out these regional differences as key in waste management planning.

Knowing these differences helps you decide where to dispose of waste. It also guides you in setting up waste management contracts. Each area has its own challenges that affect prices.

North vs South England Pricing

The South of England has higher gate fees. This is because land is scarce and costs are high. Also, stricter rules add to the expenses. London and the South East have the highest fees in England.

The North offers lower prices. This is because land is cheaper and there's more of it. But, waste from the South may face longer transport times, which can increase costs.

Prices can differ by £20 to £50 per tonne between the North and South. This makes planning important for cost-effective waste management.

Scotland, Wales, and Northern Ireland Rates

Scotland has its own waste policies. These include ambitious recycling goals and a focus on the circular economy. This leads to competitive gate fees for recyclables but higher costs for non-recyclable waste.

Wales has its own laws that affect waste disposal costs. The Welsh Government aims to reduce waste and promote efficiency. This shapes the prices at local facilities, with incentives for waste diversion.

Northern Ireland faces unique challenges due to its location and limited infrastructure. Gate fees here reflect local market conditions and cross-border regulations.

Urban vs Rural Cost Variations

Urban waste facilities charge premium rates. This is because of higher costs for land, planning, and transport. These factors make city-based sites more expensive.

Rural sites have lower base rates due to lower costs and more flexibility. But, transport costs can add up, especially for distant sites.

The gap in prices between urban and rural areas varies. Some rural sites offer competitive prices to attract urban waste. Others focus on local markets with lower prices.

Cost-Saving Strategies for Waste Management

Smart businesses are finding new ways to cut down on waste disposal costs. They use smart planning and action. It's all about saving money now and being green for the future.

There are three main ways to save on waste management. First, reduce waste and recycle more. Second, look for new ways to get rid of waste. Third, talk to service providers to get better deals.

Waste Reduction and Recycling

Reducing waste is key to saving money. Regular audits help find ways to cut down waste. This means less waste to throw away.

Recycling can also make money and save costs. Recycling costs more because it needs extra processing. But, it's good for the planet and can make money from recyclables.

Having good waste sorting systems helps get lower prices for recyclables. Training staff ensures everyone follows these practices.

Alternative Disposal Methods

Looking at new ways to dispose of waste can save a lot of money. Places like waste-to-energy facilities and anaerobic digestion for organic waste are cheaper. They also help the environment.

These options can cut costs and meet green goals. They offer a win-win situation for businesses and the planet.

When choosing alternatives, think about all costs. This includes transport, processing fees, and extra handling needs.

Negotiating Better Rates

To get better rates, know the market and show you can provide steady waste. Building good relationships with waste facilities helps a lot.

Combining waste streams and being flexible can help in negotiations. Committing to a certain volume can lead to better prices.

| Negotiation Factor | Potential Savings | Implementation Difficulty | Time to Realise Benefits |

|---|---|---|---|

| Volume Commitments | 10-25% reduction | Medium | 3-6 months |

| Flexible Scheduling | 5-15% reduction | Low | 1-3 months |

| Extended Contract Terms | 8-20% reduction | Medium | 6-12 months |

| Payment Term Adjustments | 3-8% reduction | Low | 1-2 months |

Don't just look at the basic cost when negotiating. Think about payment terms, service levels, and extra charges. These can greatly affect the overall cost.

Industry Trends and Future Pricing

The waste management industry is changing fast in the UK. New technologies, market changes, and rules are altering how we pay for waste disposal. These shifts are making pricing more complex.

Knowing about these trends is key for businesses to manage their waste costs. The industry is always evolving as companies adopt new tech and face market challenges.

Market Developments and Consolidation

The UK's waste management sector is getting bigger as big companies buy smaller ones. This leads to economies of scale, making services cheaper and more reliable for customers.

Big players are growing their networks to offer more waste solutions. This means:

- Standardised pricing across different places

- Better services and special waste handling

- More efficient operations with shared resources

- Stronger negotiating power for contracts

Smaller companies are focusing on niche markets and local services. They offer good prices for certain waste types or in areas big companies don't serve.

Technology Impact on Costs

New tech is changing how waste facilities work and price their services. Digital weighing solutions and automated systems cut costs and improve accuracy in billing.

Key tech advancements include:

- Predictive analytics for better collection routes and schedules

- Automated sorting systems that save on labour

- Real-time monitoring of waste and facility capacity

- Digital platforms for clearer prices and easier buying

These innovations help facilities manage costs better. The savings often lead to lower gate fees and better services for waste producers.

Route optimisation software is especially good for commercial waste customers. It cuts costs, and operators often pass these savings on through better prices.

Five-Year Cost Projections

Analysts say disposal costs will keep going up until 2029. This is due to tighter environmental rules, carbon pricing, and the need for new infrastructure.

But, new tech and more recycling might slow down these price hikes. Businesses that adjust their waste plans can handle rising costs. They can do this by:

- Improving recycling and waste segregation

- Investing in waste reduction tech

- Getting flexible disposal contracts

- Using alternative methods like waste-to-energy

Planning ahead is crucial for managing waste costs as the industry changes. Early preparation helps businesses keep waste management affordable.

WRAP Gate Fees Report and Industry Standards

The Waste and Resources Action Programme (WRAP) is key in the UK for waste disposal standards and gate fee reports. It gives businesses vital market insights. This helps them understand prices and plan their waste management better.

WRAP's detailed data helps make the waste market clear. Their reports show how prices change by region, season, and over time. This affects how much waste disposal costs.

“Standardised reporting ensures that waste producers can make evidence-based decisions about their disposal strategies whilst maintaining environmental compliance.”

Annual Reporting Requirements

Waste facilities in the UK must send in annual reports. These reports include how much waste they handle, their gate fees, and how much space they have. This makes sure all sites report the same way.

The reports cover different types of waste, like household and business waste. Facilities must give monthly fee updates. This helps WRAP spot trends and patterns.

Regular submission deadlines keep the data fresh and useful for planning. If reports are late, it can lead to problems with licenses and permits.

Benchmarking and Compliance

Benchmarking practices let waste producers compare their costs with the average. This helps find ways to save money and keep prices fair.

Following WRAP's reporting rules shows a facility is open and cares about the environment. Facilities that report well gain trust from clients and regulators.

The benchmarking data shows big differences in costs across regions and types of facilities. Urban facilities often charge more because of land costs and limits. But, rural sites might be cheaper.

Keeping an eye on compliance ensures good service quality. This helps avoid problems and keeps waste disposal reliable for businesses.

Conclusion

Understanding landfill gate fees in the UK needs careful planning and knowledge of the market. The focus is now on sustainable pricing that encourages recycling and reducing waste.

Effective waste management starts with knowing your local rates and waste types. Costs can vary a lot depending on where you are. It's key to research and compare different options to find the best deals.

The rules around waste disposal are changing, with taxes and levies increasing costs. This shift encourages businesses to adopt circular economy practices. Starting early with waste reduction can save more money in the long run than just looking for cheap fees.

Managing waste costs well means balancing today's expenses with tomorrow's trends. The industry values those who are proactive and responsible. Whether it's commercial or municipal waste, staying up-to-date with prices and methods is vital for controlling costs and being sustainable.