Did you fail to submit your UK R&D tax claim back last year? If your business is in the waste and resources industry it's quite likely that you didn't claim back and that you are guilty! Yes. Guilty of leaving money on the table which your business probably could really have done with!

Many in the Waste Management industry have been failing to lodge their submissions according to HMRC data. This is truly remarkable! It's an endemic failure that the industry could easily correct.

For example, in 2017-18, the waste sector accounted for less than 1% of R&D tax relief paid out. This is a heinous industry record that you can easily rectify in your own company. Simply continue reading and take action after reading this article.

The Basis for a UK R&D Tax Claim Back

If your company has improved, better developed or increased the efficiency of its processes, products, or services, you may be eligible for tax relief through UK R&D tax relief or credit.

Waste and resource management is high on the political and environmental agendas in the United Kingdom, with increasing pressure to improve performance and efficiency, achieve net-zero emissions by 2050, and develop sustainable solutions as part of a circular economy.

This has necessitated the industry adapting to increasingly stringent legislation, developing agile and flexible working practices, and innovating through R&D investment (R&D).

However, many businesses, particularly in the current Covid-19 crisis, may be discouraged from investing in R&D because it involves capital risk, often with no immediate benefit, and an uncertain return on investment.

To encourage investment in research and development, the UK government introduced a tax-break scheme for R&D in 2000. HM Revenue and Customs (HMRC) had received 300,000 claims up to 2018, resulting in £26.9 billion in tax relief (HMRC, 2019).

Since the tax break was expanded in 2012, there has been a significant increase in the number of claims. Changes to the scheme, which increased the number of eligible companies and increased the rates of relief credit that can be claimed, have largely driven this.

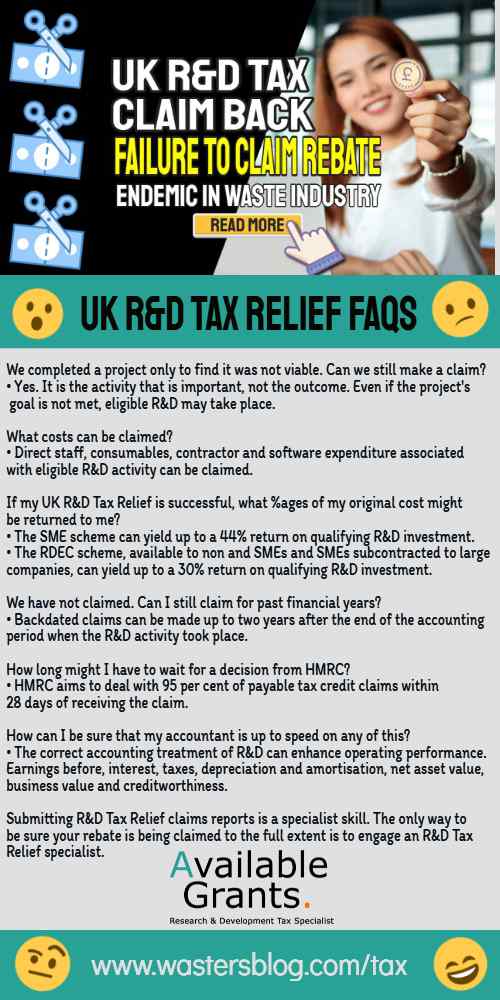

However, it is widely acknowledged that there is a lack of awareness and that there are misconceptions about R&D. Confusion also abounds regarding which companies and activities qualify as R&D. Furthermore, the time required to develop a claim, as well as the technical information required, discourages many businesses from filing claims.

But this needs to be corrected. It really need not be that difficult to claim and receive UK R&D Tax claim back cashflow benefits in any waste and resources management business.

In the sections which follow we provide basic guidance on the issues surrounding your UK R&D Tax claim back actions.

What is R&D?

R&D occurs for tax purposes when a project seeks to advance overall knowledge or capability in science or technology (HMRC, 2016).

R&D occurs for tax purposes when a project seeks to advance overall knowledge or capability in science or technology (HMRC, 2016).

This could result in the creation, or significant improvement of, a process, material, device, product, service, or source of knowledge.

Although the mention of science and technology may conjure up images of white coats and laboratories, leading people to believe that R&D relief is limited to research-focused sectors such as pharmaceuticals, this is not the case.

R&D tax breaks are also available for “brown coat” development work in design and engineering (HMRC, 2016).

Companies may also fail to make claims because they believe the achieved advance is minor or insufficient, or because they do not consider normal day-to-day activities to be R&D.

Activities must address scientific or technological uncertainty in order to qualify as R&D. To be eligible, it must be proven that the solution to a problem or question is not readily available or cannot be easily deduced by a competent professional.

If the solution to a project is uncertain and thus requires the development or advancement of knowledge and or capabilities, a UK tax rebate may be available.

Is my company eligible for R&D tax relief?

There are two types of R&D tax relief:

- R&D relief for small and medium-sized businesses (SME) and

- R&D expenditure credit (RDEC).

Companies that have fewer than 500 employees, a turnover of less than £90 million, and/or a balance sheet of less than £77 million are eligible for SME R&D relief.

(It is worth noting that these values are twice as high as the widely accepted EC SME qualifying parameters.)

Relief for R&D Is claimed by including information about qualifying expenses on the company tax return form (CT600). Companies can claim tax relief on a number of R&D activities (projects) in a single HMRC submission.

Claims must be accompanied by a technical report outlining the scientific/ technological advances and uncertainties encountered, as well as details of the work completed, a timeline, and a description of how the activity meets eligibility criteria.

Support for R&D claims

As the number of R&D tax-relief claims has increased, so has the number of specialist R&D tax advisers and full-service accountants offering a variety of approaches, services, and fees.

The complexity of the R&D activities, the experience of your existing accountant, and the time available for R&D staff to produce technical reports all play a role in determining the right level of support – and the associated cost.

Why More and More Companies are Engaging an R&D Claims Specialist

It is critical that your claim is completed correctly in order to obtain the maximum value benefit that your company is entitled to. Accountants, brokers, and financial advisors prefer to leave the chore of claiming to experts due to the nature and complexity of the R&D report.

For example, the specialist advisors at Available Grants™ partner with you and your team and seek the Win-Win in all they do.

HMRC has checks and balances in place, and Available Grants™ knows what they expect. As a result, their highly polished team is well-positioned to ensure a smooth journey. This saves you time and hassle and allows you and your company to continue achieving your objectives.

Indeed, a successful claim so obviously brings much-needed cash back into the business, that it's hard. Yes. Hard to conceive why anyone still reading this would not follow up on this opportunity.

Visit the Available Grants™ website for more information. Click here.

UK R&D Tax Claim Back – References

HMRC (2016), Research and development tax relief: making R&D easier for small companies, HM Revenue and Customs, London.

HMRC (2019), Research and development tax credits statistics: October 2019, HM Revenue and Customs, London.