Top 20 Waste Management Companies in the UK in 2024

For business managers to select the best waste management contractor to appoint, to remove their waste, they need to understand the relative sizes and capabilities of the main operators.

Everyone wants a clean and sustainable environment. Here's good news: The “UK Waste Management Top 20 Companies“ list for 2024 is out now. And, it's right here on this page below!

The Top 10 UK Waste Management Companies List 2025 is now out! Click Here!

Our article will guide you through these top companies, their services, and why they matter. It helps by making it easier to understand who does what in keeping our places clean and green.

Each company on our list plays a big part in waste recycling and sustainability efforts across the United Kingdom.

Ready to learn more? Keep reading.

Key Takeaways

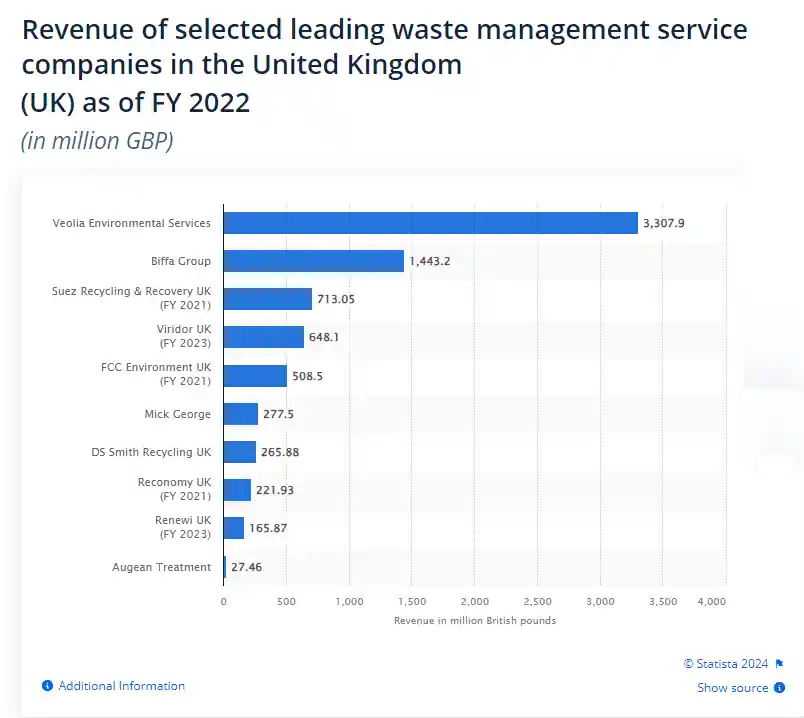

- Veolia Environmental Services leads the UK waste management market with £3,308 million in revenue (2022). It operates in 35 countries and employs over 78,000 people.

- Biffa collects the waste from over 2.5 million homes getting rid of theur rubbish weekly and earns £1,443 million a year (2022).

- Recycling is key for these companies to cut landfill use and greenhouse gas emissions.

- The UK plans to raise its landfill tax by just over 22% in April 2025, affecting how companies manage waste.

- Mergers are common as companies aim to grow bigger and improve services.

Leading Waste Management Companies in the UK

The UK takes pride in its robust waste management sector, guided by giants like Veolia Environmental Services and Biffa Group. These entities set the pace with their innovative approaches to recycling, energy recovery, and sustainable trash handling.

List of the Top 20 UK Waste Management Companies

The following list ranks the top 20 companies by revenue, using the latest 2022 data.

1. Veolia Environmental Services Overview

Veolia Environmental Services works in waste management. It makes £3,308 million a year (according to the latest Statista research figures for 2022). This company is big around the world too, earning €24.8 billion. They have jobs for about 78,000 people in 35 countries.

Our job is to turn waste into something useful again.

2. Biffa Group Profile

Biffa Group is the second largest name in waste management in the UK (England Wales & Northern Ireland). They work out of their HQ in High Wycombe, England.

This company helps about 2.5 million homes get rid of trash. Every week, they collect bins from all these homes – that's over 4 million bins! Their revenue stands strong at £1,443 million (2022).

Biffa plays a huge role in keeping our communities clean and supports the circular economy by recycling and reusing what we throw away.

Next up, let's look into Viridor (Pennon Group) and see how they stack up in this industry.

3. Suez Environnement UK

Suez Environnement UK made £713 million in turnover. It changed its name from SITA UK to SUEZ Environnement in March 2015. This company works in more than 70 countries and runs over 40 brands.

They help manage waste across the UK, turning rubbish into resources like biogas and recycled materials.

Their work supports renewable electricity and clean energy goals. The group plays a big part in sustainable waste management, aiming for net zero emissions from their operations. They focus on recycling plastic, electronic waste, and more, helping urban areas handle rubbish better while fighting global warming.

4. Viridor (Pennon Group) Analysis and Revenue

Viridor, part of Pennon Group, started in 1956 as Harrison. Pennon bought it in 1993. Now, it's worth over £1.5 billion. Its UK income hit £648 million recently (2022). This company plays a big role in waste disposal and recycling.

They turn trash into energy and recycle things to keep our planet clean.

They work hard on waste management services across the UK. Viridor deals with household waste and more complex rubbish like hazardous materials. Their efforts support circular economies by making sure that what can be reused, is reused – aiming for a greener future every day.

5. FCC Environment Details and Revenue

FCC Environment operates in the waste management sector, focusing on integrated waste solutions. The company generated £508 million in revenue in 2022. It is based in Northampton and employs over 36,000 people worldwide.

In 2000, it expanded by acquiring Hanson Waste Management for £185 million. FCC Environment plays a vital role in advancing sustainability through effective waste recycling and management practices.

6. Mick George

Mick George Ltd is a prominent waste management company in the United Kingdom, and had a turnover of £277 million in 2022, and is known for offering a comprehensive range of waste collection services tailored to both commercial and residential clients.

The company specializes in waste collection, recycling, and disposal solutions, aiming to minimize environmental impact through innovative waste reduction and recycling methods.

In addition to waste management, Mick George Ltd provides other related services such as skip hire, demolition, and aggregate supply. Founded over 40 years ago, the company has grown significantly in recent years.

7. DS Smith Recycling UK Financials

DS Smith Recycling UK is a key player in waste management. The company focuses on recycling services. They reported revenue of £265 million (in 2022). This makes them a main leader in the sector.

DS Smith aims to create a closed loop for materials, reducing waste.

Their efforts support sustainability and environmental protection. They use innovative methods to recycle mixed waste efficiently. Investing in these processes helps drive their growth and improve green energy solutions, aligning with future goals for diverse energy sources and resource management.

8. Reconomy

Reconomy with a 2021 revenue of £222 million specializes in offering sustainable waste management solutions to various sectors, including construction, commercial, and industrial.

Founded in the early 1990s, Reconomy has built its reputation on facilitating efficient waste reduction, recycling, and disposal processes, helping businesses to manage their waste streams more effectively and sustainably.

The company prides itself on leveraging technology to provide data-driven insights that enable better waste tracking, reporting, and compliance with environmental regulations. Reconomy’s services extend beyond waste handling to include site segregation, skip hire, and complex waste project management. Reconomy's approach supports businesses looking to manage their waste better while adhering to regulations like the Environmental Protection Act 1990.

With a strong focus on circular economy principles, Reconomy aims to transform the way resources are managed in the industry, promoting waste minimization and the conversion of waste into valuable resources. This commitment to sustainability and innovation makes Reconomy a key player in advancing environmental goals in the UK’s waste management sector.

9. Renewi (Shanks Group)

Renewi, part of the Shanks Group, focuses on waste management and recycling. The company aims to turn waste into valuable products. It generates a revenue of £166 million. This helps them specialise in waste-to-product services.

Renewi plays a key role in reducing environmental impact while promoting sustainable energy solutions. Their efforts contribute to a cleaner future by emphasising the importance of recycling and waste minimisation.

The firm operates various facilities across the UK. These include advanced recycling plants that convert materials into new resources. By investing in infrastructure, Renewi enhances its capabilities in handling diverse types of waste.

Such actions support broader goals like climate change mitigation and resource conservation within the waste management sector.

10. Amey Environmental (Ferrovial) Revenue

Amey Environmental is part of the Ferrovial group. It generated has moved down from number 6. The company focuses on integrated waste management and recycling services. They also play a key role in the UK's waste collection efforts, helping to reduce waste generation.

11. Enva Group (DCC) UK Business Report

Enva Group, part of DCC, focuses on waste management and recycling. They reported a revenue of £210 million. Their work centres on environmental solutions to enhance sustainability.

Enva aims to reduce landfill use by increasing recycling rates. They provide services like electronic waste recycling and hazardous waste management. The company supports the bio-economy through innovative methods in waste treatment and renewable energy development.

12. Serco Waste Management Profile

Serco Waste Management offers various waste services in the UK. Their focus includes recycling, disposal, and treatment of waste. In 2024, their revenue stands at £160 million. This company provides integrated waste management solutions to help tackle climate change economics and improve environmental protection.

Their services aim to promote sustainability through effective waste-to-energy practices. Serco plays a crucial role in managing resources efficiently while driving innovation in cleantech initiatives.

They also engage with employees to foster diversity and inclusion within their operations.

13. Day Group Business Overview

Day Group provides vital waste management services. They focus on recycling and the supply of aggregates. Their revenue stoods at £148 million in 2021. This company plays a key role in promoting environmental protection through effective waste solutions.

They contribute to reducing landfill use by enhancing recycling efforts across the UK.

They are part of a growing sector in sustainability. More companies partner with them for effective waste solutions.

14. Tradebe Environmental Services Profile

Tradebe Environmental Services focuses on waste management. They handle hazardous waste with care. Their revenue stands at £126 million. The company operates across the UK and provides essential services for safe disposal and recycling of harmful materials.

Tradebe’s commitment helps protect the environment and supports sustainable practices in waste management.

15. Cory Riverside Energy Business Review

Cory Riverside Energy focuses on waste management and energy production. The company operates waste-to-energy plants, turning rubbish into electricity. Their revenue stoods at £118 million in 2020.

This income comes from running these facilities efficiently. By converting waste, they help reduce landfill use and provide clean energy solutions.

Their services fit well within the UK’s growing need for sustainable waste handling practices. Cory Riverside Energy plays a key role in making the country greener while managing resources better.

16. Grundon Waste Management

Grundon Waste Management focuses on recycling and waste solutions. The family-owned business earns close to £118 million annually. They aim for sustainability in all operations. Grundon offers services like industrial cleaning, hazardous waste disposal, and energy-from-waste facilities.

They contribute to UK environmental goals through effective resource management. Their efforts help reduce landfill use and promote recycling practices. This positions them as a key player in the sector's growth.

Next, we will explore insights into Enovert Company.

17. Enovert Company Insights

Enovert focuses on waste management and recycling. The company is known for its landfill operations and energy recovery processes. Enovert generates revenue of £112 million. Its services include managing landfill sites and recycling facilities effectively.

This helps reduce waste and promotes environmental sustainability. Understanding companies like Enovert is essential for professionals in the waste management sector as they adapt to new regulations, like rising landfill taxes and extended ETS rules in 2025.

18. SRCL (Stericycle) Profile

SRCL, also known as Stericycle, focuses on medical waste management. The company generated £102 million in revenue in 2020. It plays a vital role in safely handling and disposing of hazardous materials.

SRCL ensures compliance with safety regulations while providing essential services to healthcare facilities. This helps protect the environment and public health from harmful waste gases often found in medical settings.

19. Hills UK Financial Overview

Hills UK focuses on waste management and recycling. Their revenue reached £101 million in 2020. They offer diverse services in this field. Hills UK aims to reduce landfill usage and promote sustainability.

The company plays a vital role in improving waste solutions across the country. They work hard to enhance recycling rates and support environmental goals. Through partnerships, they strive for effective waste-to-energy projects as well.

20. Palm Recycling Business Report and Revenue

Palm Recycling focuses on recycling paper and cardboard. The company generated revenue of £85 million (2020). This success highlights the significance of waste management in the UK. Investing in recycling benefits the environment and boosts local economies.

Palm Recycling aims to reduce landfill use and promote sustainability.

Historical Development of Leading Companies

Biffa Group was a top firm in waste management during the late 2000s. It faced changes when Cleanaway joined Veolia, leading to Veolia's rise in rank. In 2003, Waste Recycling Group was bought by Terra Firma Capital Partners for £315.2 million.

At the time, this deal changed the landscape of waste management companies in the UK.

In 2012, FCC Environment emerged from a merger between FOCSA SERVICES and Waste Recycling Group. This step expanded their services and market reach significantly.

Other firms like Viridor and Suez Environnement have also shaped this industry over time by making key investments and acquisitions.

These movements highlight how mergers play a crucial role in shaping today's waste management sector and its future trends.

The next section will cover mergers and acquisitions in UK waste management since 2000.

Mergers and Acquisitions in UK Waste Management Since 2000

The waste management sector in the UK has seen many changes since 2000. Mergers and acquisitions have played a big role in shaping the industry.

- Waste Recycling Group acquired Hanson Waste Management for £185 million in 2000. This boosted their market presence significantly.

- Viridor bought Churngold's waste business in 2003. This acquisition expanded their operations and service offerings.

- In 2004, Viridor acquired Thames Waste Management. This move helped them grow further.

- In 2006, they took over Somerset LAWDC Wyvern Waste. This strengthened their position in the region.

- FCC Environment purchased Waste Recycling Group for £1.4 billion in 2006. This major acquisition made FCC a key player in the market.

- The sector has continued to evolve with new firms joining and existing ones merging to increase efficiency and reach.

- Companies focus on gaining advantages through strategic partnerships or buyouts.

- New regulations are pushing firms to adapt and innovate, affecting merger strategies too.

- Industry competition is driving companies to seek growth through acquisitions, improving services through many projects including recycling and waste-to-energy initiatives.

- Changes often create challenges but also present opportunities for better resource management and environmental efforts in the UK waste sector.

In-Depth Profile of Top 5 Waste Management Firms

This section focuses on the top five waste management companies in the UK. Each firm plays a key role in managing waste and promoting sustainability.

Detailed Look at Veolia UK

Veolia UK operates in 35 countries. They employ around 78,000 people. In the UK, their revenue for 2017/2018 was £1.5 billion. Globally, Veolia had a revenue of €24.8 billion.

Veolia focuses on waste management and water services. They aim to improve environmental quality through efficient waste solutions like recycling and waste-to-energy projects. This helps reduce landfill use and lower carbon emissions in the UK market.

Detailed Look at Biffa Group Company

Biffa Group is a major player in UK waste management. Based in High Wycombe, it serves around 2.5 million households. The company generates £1,091 million in revenue annually. Biffa focuses on recycling and resource recovery, helping to reduce landfill use.

Their services include general waste collection and hazardous waste management. Biffa invests in technology for efficient operations. They also promote sustainability through various initiatives.

As part of the Pennon Group PLC, they align with strong environmental practices and goals within the sector.

Insight into Suez Environnement UK

Suez Environnement UK operates as a major player in waste management. The company focuses on recycling, treatment, and recovery of waste materials. They manage over 10 million tonnes of waste each year in the UK alone.

In March 2015, Sita UK rebranded to become Suez Environnement UK. Their revenue reached £767 million post-rebranding. They run more than 40 brands across over 70 countries globally.

This wide reach allows them to tackle various environmental challenges effectively while contributing to urbanisation efforts through sustainable practices like waste-to-energy initiatives and anaerobic digestion processes.

Detailed Look at Viridor (Pennon Group) Company

Viridor, part of the Pennon Group, has a strong presence in UK waste management. It generates revenue of £853 million. The company focuses on recycling and energy recovery. Viridor aims to reduce landfill use through innovative solutions.

It provides services to both businesses and local authorities.

Founded in 1993, it was acquired by Pennon for over £1.5 billion. This move boosted its market position significantly. With a diverse portfolio, Viridor operates numerous facilities across the UK.

Services include waste collection, treatment, and converting waste into energy—using advanced technologies like waste-to-energy plants.

Detailed Look at FCC Environment

FCC Environment is a major waste management firm in the UK. It operates in recycling and waste treatment. The company focuses on turning waste into energy and resources. In 2023, FCC Environment earned £676 million.

This revenue highlights its significant role in the market.

Based in Northampton, FCC employs over 36,000 people around the globe. Their services support businesses to manage their waste effectively while meeting environmental standards. By transforming waste streams, they help companies reduce their carbon footprints and promote sustainability efforts.

Revenue Comparisons and Sector Insights for the Next Year (2025)

In 2025, the government UK plans to raise its landfill tax by 22%. This change could impact waste management firms significantly. Upcoming UK ETS regulations changes will mean that UK ETS charges will also apply to incinerators, adding another layer of challenge.

These shifts may affect how these companies operate and generate revenue in the near future.

Frequently Asked Questions on UK Waste Management

Waste management can be complex. Many people have questions about it.

1. What are the main waste management companies in the UK?

The top five are:

- Veolia,

- Biffa,

- Viridor,

- Suez, and

- FCC Environment.

2. How much revenue do these companies generate?

In 2019/2020, the top five reported a total revenue of £4.8 billion. This shows their significant impact on the sector.

3. Why is UK landfill tax increasing?

The UK landfill tax will rise by 22% in April 2025. This aims to encourage more recycling and less waste disposal in landfills.

4. What is waste-to-energy?

Waste-to-energy involves converting non-recyclable waste into usable energy. This process helps reduce landfill use while generating power.

5. How are UK ETS regulations changes affecting waste management?

New rules will extend to incinerators in 2025, meaning stricter controls on emissions from these facilities.

6. What mergers have occurred since 2000?

Many firms merged or acquired others to scale up operations and improve efficiency. These changes shape the current landscape of waste management.

7. Which company has the most comprehensive services?

Veolia is known for its full range of waste management services in the UK. They handle everything from collection to recycling and disposal.

8. What trends should we expect in 2025?

Expect changes due to rising taxes and strict regulations aimed at reducing fossil fuel use and promoting sustainability.

9. How can professionals stay informed about industry changes?

Following updates from key organisations and attending industry events can help stay up-to-date with developments in waste management practices.

10. Why should businesses care about effective waste management?

Effective waste management reduces costs, improves public image, and meets legal obligations while supporting sustainability goals.

11. How is energy production linked with the work of these waste management companies?

Many of them focus on ‘waste to energy' initiatives – converting refuse into syngas or heat via power plants instead of relying on fossil fuels such as coal… It's an eco-friendly alternative!

12. How important is market research for these leading UK waste management businesses?

Market research plays a critical role… It helps understand trends, monitor bounce rates on websites or cookies data… All this information aids strategic decision-making!

Text in panel